The growth is now coming not from insecticides or fungicides, but herbicides. And the driver for that is shortage of labour for manual weeding.

Crop protection chemicals are commonly known as “pesticides”. These are basically substances sprayed on crops to protect against insects (“pests”) that cause damage, whether directly (by feeding on them) or indirectly (by transmitting disease).

Take the white-backed plant hopper, a pest that both feeds on rice plants and also spreads the Fiji virus disease, resulting in their stunted growth. This “dwarfing” disease has been reported by many paddy farmers in Punjab and Haryana during the current kharif growing season. The vector insect here injects the virus while sucking the sap from mostly young plants.

But crop protection chemicals aren’t limited to insecticides. They also include fungicides (to control fungal diseases such as blast and sheath blight in rice or powdery mildew and rusts in wheat) and herbicides (to kill or inhibit the growth of weeds).

The fastest-growing segment

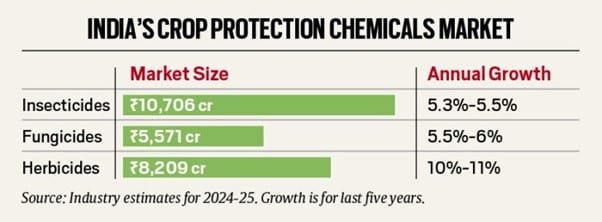

India’s organised domestic crop protection chemicals market is valued at roughly Rs 24,500 crore.

The largest segment within that is insecticides (Rs 10,700 crore), followed by herbicides (Rs 8,200 crore) and fungicides (Rs 5,600 crore). As the accompanying chart shows, it is the market for herbicides that’s growing at the highest rate – over 10% annually.

Much of that is controlled by multinational companies: Bayer AG (which has an estimated 15% market share), Syngenta (12%), ADAMA (10%), Corteva Agriscience (7%) and Sumitomo Chemical (6%). While Bayer is German, Corteva is from the US and Sumitomo is Japanese, the Basel (Switzerland) and Ashdod (Israel)-headquartered Syngenta and ADAMA respectively are both owned by the Chinese state-owned Sinochem Holdings Corporation.

Explained | Micro-Fertilizers Manufacturers Urges to Remove Non-Subsidised Fertilizer

However, the herbicide segment has Indian players, too, such as Dhanuka Agritech (estimated 6% share) and Crystal Crop Protection Ltd (CCPL: 4%). CCPL recently purchased the rights to Ethoxysulfuron, a herbicide used against broad-leaved weeds and sedges in rice and sugarcane, from Bayer AG for sales in India, Pakistan, Bangladesh and Southeast Asian countries.

The deal, announced in January 2025, also covered the latter’s ‘Sunrice’ trademark for mixture products containing this active ingredient. Earlier, in December 2023, CCPL had acquired ‘Gramoxone’, a broad-spectrum herbicide containing the active ingredient Paraquat, from Syngenta for sale in India.

“We are very bullish on herbicides. While the all-India market for this segment grew by 10% in 2024-25 (from Rs 7,460 crore to Rs 8,209 crore), our own sales rose over 47%, from Rs 229 crore to Rs 337 crore,” said Ankur Aggarwal, managing director of the Delhi-based company that recorded a turnover of Rs 2,201 crore from crop protection chemicals last fiscal.

The growth driver – farm labour shortage

Weeds, unlike insect pests and disease-causing pathogens, don’t directly damage or destroy crops. Instead, they compete with them for nutrients, water and sunlight. Yield losses happen because the crops are deprived of these essential resources. Besides growing at their expense, weeds sometimes even harbour pests and pathogens inflicting further harm.

By keeping their fields free from weeds, farmers can ensure that the benefits of the fertilisers and irrigation water they give go to the crops and not these unwanted plants.

Weed control has traditionally been through manual removal by hand or simple lightweight short-handled tools with flat blades such as khurpi. There are also power weeders with 3-10 horsepower engine capacity that can be run between rows of standing crops to remove weeds in and around those spaces.

Also Read | Parliament Panel Proposes Roadmap to Boost Sustainable Farming

But manual weeding is time-consuming, with a labourer taking 8-10 hours to cover one acre. And since the weeds regrow, the process has to often be repeated during the crop’s lifecycle. According to the Labour Bureau’s data, the all-India daily wage rate for plant protection workers averaged Rs 447.6 in December 2024, as against Rs 326.2 five years ago.

More than the cost though, labour isn’t available when required by the farmer. Power weeders take only 2-3 hours per acre, but aren’t effective in pulling out weeds with deep roots or growing within densely planted crop areas. That’s where herbicides come in. The demand for these chemicals is growing mainly on the back of rising agricultural

labour scarcity; the number of people in rural India prepared to do this work of bending, digging and uprooting plants for long hours are getting fewer by the day.

In other words, herbicides have become more like tractors and other labour-saving farm machinery – a substitute for manual weeding.

How the market is evolving

Farmers generally spray insecticides and fungicides only when they physical observe and assess the pest population or disease incidence to be significant enough to impact crop yield and quality/marketability.

There’s a certain so-called economic threshold level, where the cost of controlling the pest/disease using chemicals is

justified by the extent of anticipated crop loss. In herbicides, too, farmers tend to mostly spray only after the weeds appear and are seen, i.e. “post-emergence”.

In recent times, farmers have also been resorting to prophylactic application of “pre-emergent” herbicides around or just after crop sowing. These stop the weeds from coming out, helping keep the field clean from the start. Alternatively, they may use “early post-emergent” herbicides to control weeds at the crop’s initial sensitive growth stage.

In both cases, the spraying is preventive, as opposed to being reactive. Out of the estimated Rs 1,500-crore paddy herbicide market, the “pre-emergent” sub-segment accounts for roughly Rs 550 crore. That share is about a fifth in the Rs 1,000-crore market for wheat herbicides. The “pre-emergent” and “early post-emergent” spaces are clearly the ones leading the growth, as farmers increasingly opt for timely and smart weed control amid rising labour shortages.

Monopoly concerns

Unlike seeds and fertilisers – where there are enough Indian public as well as private sector players – the crop protection chemicals industry is practically a multinational monopoly. There are some Indian companies, nevertheless, that are attempting to break through, by acquiring the rights to active ingredients and brands from big global majors or even introducing innovative formulations.

CCPL, for instance, has collaborated with the Ohio (US)- based Battelle and Japan’s Mitsui AgriScience to develop a new paddy herbicide called ‘Sikosa’. Containing two active ingredients, Bensulfuron-methyl and Pretilachlor, in a patented oil-dispersion formulation, ‘Sikosa’ spreads quickly in water and works well when sprayed within 0-3 days after transplanting.

“With a single 500-ml bottle of this super spreader herbicide, farmers can control narrowleaf, broadleaf and sedge weeds in transplanted paddy. And the product cost is Rs 850-900 per acre, compared to Rs 2,000-plus with manual weeding,” Aggarwal claimed.

But India is still some distance away from having a Sinochem Holdings Corporation.

Written by Harish Damodaran, Harish Damodaran is National Rural Affairs & Agriculture Editor of The Indian Express.

Disclaimer: This content, except the heading has not been generated, created or edited by Agrinews.in

Publisher: The Indian Express.

Add Comment